Ifsc Code Mandiri

Where to Find the IFSC & MICR Codes on a Cheque?

You can easily find both the IFSC and MICR codes on the bank’s chequebook and passbook. The IFSC is printed on the top of the cheque leaf, while the MICR code is printed on the bottom of the same leaf. You can also find both these codes on the first page of the passbook provided by the bank branch.

National Electronic Fund Transfer (NEFT)

NEFT or National Electronic Fund Transfer is a nationwide electronic fund transfer system that lets you transfer money from one bank account to another. It is a safe and hassle-free process as it is monitored by the RBI. All NEFT settlements are made in a batch-wise format, and funds can be sent through NEFT to accounts of all Indian NEFT-enabled banks. To initiate an NEFT transfer, you would need the account number and name of the receiver, along with the name of the bank branch and its IFSC.

is short for Indian Financial System Code and represents the 11 digit character that you can usually see on your bank’s cheque leaves, or other

sponsored material. This 11 character code helps identify the individual bank branches that participate in the various online money transfer options like NEFT and RTGS.

IFSC (Indian Financial System Code) is an acronym used to represent a unique code assigned to each bank branch in India. This code is utilized by the Reserve Bank of India (RBI) for electronic money transfers between banks, enabling them to verify the transfer of funds. Without the IFSC code, National Electronic Funds Transfer (NEFT) transactions cannot be processed. Individuals need to provide the

when transferring money through various options such as NEFT, RTGS, IMPS, and internet banking. It helps in identifying the specific bank branch involved in a transaction and is essential for processing online transactions.

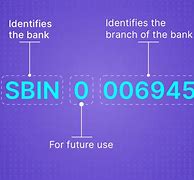

11-characters alphanumeric IFSC code includes both letters and numbers. The first four characters represent the bank code, the fifth character is always zero, and the last six characters identify the specific branch of the bank. This unique code helps to ensure that the funds are transferred to the correct recipient and destination.

The IFSC code is crucial for conducting electronic fund transfers securely and efficiently. It helps to minimize errors and ensures that the funds are transferred to the intended recipient's account. Additionally, the use of IFSC codes also helps in the reconciliation of transactions and tracking of funds.

In addition to electronic fund transfers, the IFSC code is also used for various other financial transactions such as online bill payments, investment in mutual funds, and insurance premium payments. It is an essential component of the Indian financial system and plays a vital role in facilitating seamless and secure financial transactions across the country.

Overall, the IFSC code is a key element of the Indian financial system, enabling the smooth and efficient transfer of funds between different banks and branches. It is an integral part of modern banking and has greatly simplified the process of electronic fund transfers in India.

Salah satu rahasia penting dibalik setiap transaksi elektronik di India adalah IFSC Code atau Indian Financial System Code. Dalam blog ini, kita akan membahas segala sesuatu tentang IFSC Code, dari definisi hingga cara kerjanya. Simak info selengkapnya dibawah ini!

IFSC atau Indian Financial System Code, adalah kode unik yang digunakan dalam sistem perbankan India. Kode ini membantu mengidentifikasi bank dan cabang yang terlibat dalam transaksi elektronik di India. IFSC sangat penting untuk memastikan dana ditransfer dengan benar dan ke cabang yang tepat.

IFSC (Indian Financial System Code) adalah kode unik sepanjang 11 digit yang digunakan dalam transaksi keuangan elektronik di India. Format IFSC mencakup elemen berikut:

Baca Juga: Apa Itu IBAN Code? Pengertian, Cara Cek dan Perbedaannya

Can I transfer money without an IFSC code?

No. This code is mandatory for conducting online transactions through NEFT, IMPS or RTGS.

Is IFSC Code and Customer ID the Same?

No, the IFSC code and customer ID are not the same. The IFSC code used to identify a specific bank branch for electronic fund transfers, while a customer ID is a unique identifier assigned to an individual customer by a bank to manage their accounts and services. The IFSC code is essential for transactions, while the customer ID is used for account management and customer identification.

Address: PLAZA MANDIRI 36-38 JL. GATOT, SUBROTO KAV JAKARTA 12190, INDONESIA

General instructions for international payments to banks in INDONESIA:

Standard Settlement Instructions (SSI) contain the list of correspondent banks of BANK MANDIRI (PERSERO), PT. for each currency.

To track a SWIFT cross-border payment to or from BANK MANDIRI (PERSERO), PT., you need a UETR code, reference number, amount, payment date, and currency. This information is typically found in an MT103 form.

We are doing our best to demystify cross-border payments, however TrackMySwift is not responsible for any delays or losses related to usage of the information and services from our web site. Please contact your banks to receive a safe advise. Country-specific payment instructions have been prepared based on Global Wires Payments Formatting Requirements Guide from J.P.Morgan.

Is IFSC code only for India?

Yes, this code is used only for transactions conducted within India. For foreign transactions, the SWIFT code is used.

Step 1: Verify the IFSC Code

Step 3: System Validates the Branch Code

How Many Digits Are There in IFSC Codes?

An IFSC code has 11 characters. This alphanumeric code consists of the bank identifier (the first 4 letters), a zero (as a separator), and a 6-digit branch code that uniquely identifies each branch.

Is it safe to share IFSC Code?

Yes, it is safe to share your bank IFSC. The transaction can only be completed if the other person knows your bank account number, name and IFSC.